This type of savings account is a great way to organise your money and track your savings goals.

Add Savings Pots to your Spend & Save account

Savings Pots are available if you have a Spend & Save or Spend & Save Plus bank account. The easiest way to open them is in the TSB app.

Spend & Save Plus Savings Pot rate

1.80% AER (Variable)

Get our highest rate Savings Pots with a Spend & Save Plus account. £3 monthly account fee applies for Spend & Save Plus accounts.

Spend & Save Savings Pot rate

1.70% AER (Variable)

Enjoy Savings Pots on the standard rate with our Spend & Save account which has no monthly account fees.

If you put in £1,000 when you opened the account and make no withdrawals and no further deposits, and assuming the interest rate stays the same for 12 months.

| Interest rate | Interest earned | Balance after 12 months | |

|---|---|---|---|

| Spend & Save Plus Savings Pots | 1.78%/1.80% Gross/ AER (Variable) | £18.00 | £1,018.00 |

| Spend & Save Savings Pots | 1.68%/1.70% Gross/ AER (Variable) | £17.00 | £1,017.00 |

The Annual Equivalent Rate (AER) shows what the interest would be if the interest was paid and added to the account once each year. It lets you compare savings accounts easily.

Interest is calculated daily and paid monthly. Rates and information correct as at 07/12/2025.

What are Savings Pots?

A clever way to save

- Our Savings Pots earn 1.80% AER (variable) with Spend & Save Plus or 1.70% AER (variable) with Spend & Save

- Add or withdraw money whenever you want with a few taps in the app

- Organise your money in up to 5 pots and save a maximum of £100,000 in each

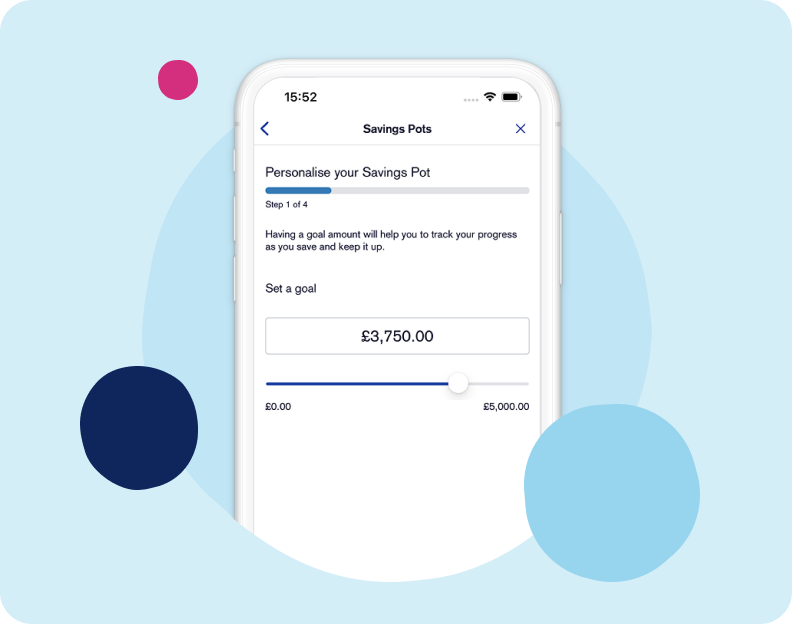

Track your savings goals

- Set a goal for each Pot to easily track how your savings are growing

- Customise Pots with goals, names, and even add a picture to help motivate you

- Lock your Pots to stop dipping into your savings (you can unlock it if you need it)

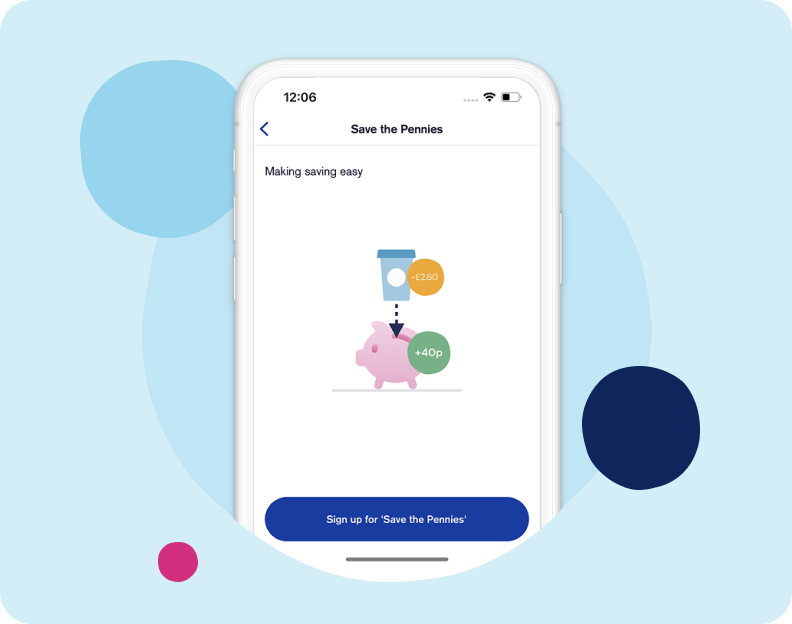

Make it automatic

- Turn on Save The Pennies to round up your card payments to the nearest pound and put the difference into a Savings Pot

- Set up a standing order to help reach your savings goals without thinking about it

Ready to apply?

Open a Savings Pot in the app

![]() You'll need a Spend & Save or Spend & Save Plus account

You'll need a Spend & Save or Spend & Save Plus account

And be 18 or over, and a UK resident

![]() Head to the TSB app, log in, and open a Savings Pot

Head to the TSB app, log in, and open a Savings Pot

Don't bank with us?

You'll need to apply for a Spend & Save or Spend & Save Plus account to open a Savings Pot

If you’d rather apply in branch you can book an appointment in advance.

Here's the details

Important Information

*Variable means the interest rate on your savings can change. The rate can go up and down. If it goes up, you earn more interest. If it goes down, you’ll earn less interest, but we’ll tell you before this happens. If you’d like to know more about what might happen to our variable interest rates when the Bank of England changes the Base Rate, head over to our Popular Questions page at www.tsb.co.uk/savings/

The Annual Equivalent Rate (AER) shows what the interest would be if the interest was paid and added to the account once each year. It lets you compare savings accounts easily. Gross rate means that credit interest is paid without income tax being deducted. Tax-free is the contractual rate of interest payable where interest is exempt from income tax.

You need to be 16+ and UK resident to open most of our savings accounts with the exception of Savings Pots and TSB ISAs. For children under 16 please see specific pages for opening procedures.