Together we can end domestic abuse.

How to remortgage

A mortgage is often the biggest financial commitment we make.

And a lot can change over the years a mortgage deal lasts, from interest rates to property values and our own personal circumstances.

Whether you are coming to the end of a fixed rate, would like to release equity to pay for home improvements, or simply want to check you’re on the best deal available to you, you may be ready to get a better understanding of remortgaging.

Thinking about remortgaging this simple comprehensive guide will give you the confidence to make an informed choice and take the next steps.

What is remortgaging?

Remortgaging means moving from one mortgage lender to another.

This can be done for a variety of reasons; you might want to find a cheaper or more affordable mortgage - one with a lower interest rate or a longer term (you’ll pay more in the long run, but your monthly payments could be more affordable) or borrow more to cover big expenses.

If you have enough equity in your house, for example, following an increase in the value, you could remortgage to extend your borrowing by releasing some of this money.

A mortgage can usually be spread over a longer repayment period than a personal loan so can be a more affordable option for borrowing.

Covering the costs of large-scale home improvements (everything from loft conversions to extensions) or raising money to pay off debts may all be possible.

If your home is worth more now than when you took out your mortgage, you may be able to borrow more when you remortgage, and the money can be used to pay for home improvements such as an extension.

Remember, house prices can increase but prices can also fall, so you should be careful that a drop in value would not leave you in negative equity - owing more on your mortgage than your property is worth.

You should also be sure you can afford the higher repayments on any new mortgage.

If you have enough equity in your property, you may be able to borrow more when you remortgage and use the money to pay off other debt such as credit cards or loans.

Mortgage rates are typically lower than other forms of lending, as they are secured against your home. So, your overall repayments could be lower, but your home is at risk if you fail to keep up with repayments.

As you are likely to be paying the mortgage over a longer term, you may pay significantly more over the full term.

What should you do if your mortgage deal is coming to an end?

It’s important to review your mortgage needs regularly - to make sure your current mortgage product is the best for you.

If your current mortgage deal is coming to an end, shop around to see if you can get a better interest rate and/or reduce monthly payments by switching. If you choose not to, your mortgage will be moved to your lenders’ standard variable rate, which is usually a more expensive option.

Things to consider when looking to remortgage; Do you want to change the length of your mortgage term? Shortening it will mean you pay your mortgage off earlier, but your monthly repayment may increase, or you might want a longer-term product to make things more affordable now, reducing your monthly repayment.

Perhaps you are looking for a mortgage that allows you to overpay with no penalty charge? Or could a fixed rate mortgage provide financial security and peace of mind in uncertain times?

Does it cost money to remortgage?

There are usually some fees associated with switching to a new mortgage - so take care to check these before you make any decisions.

Will these fees outweigh any potential savings? Can you afford to cover any upfront costs?

Fees may include valuation and product fees. Some lenders may offer a fees free remortgage.

Can you remortgage with a bad credit rating?

Remortgaging is a similar process to applying for a new mortgage, so lenders will carry out the same credit and affordability checks.

The better your credit rating, the more likely you are to be offered the lowest interest rates and the most attractive mortgage terms.

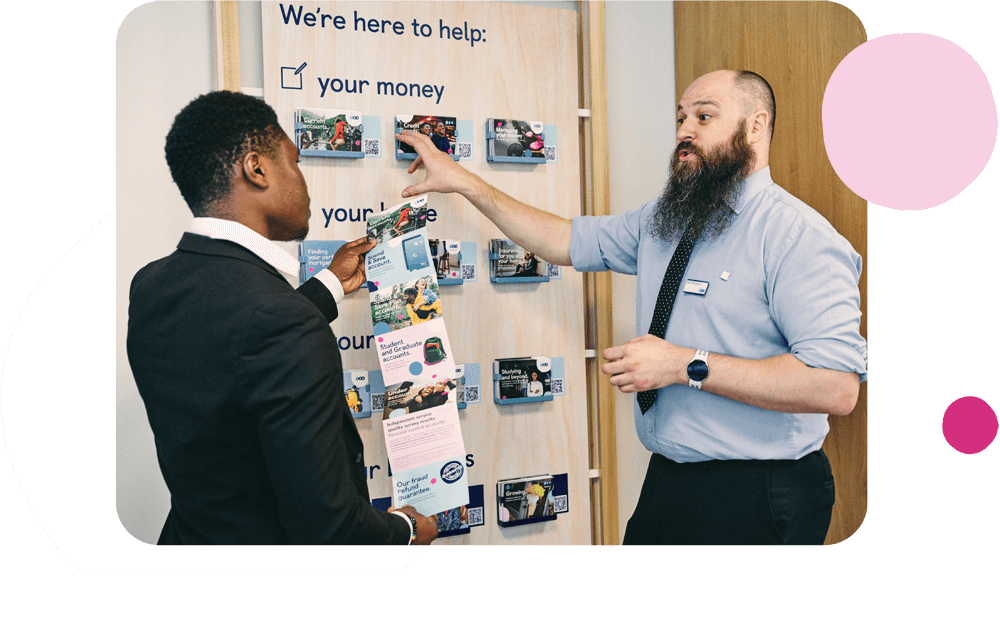

Speak to a Money Confidence Expert

Whether you bank with us or not, we’re here to make banking better for everybody. Our goal is to help you get more from your money. And chatting to us is completely free.